How Trump’s Tariffs Hit Hard? What Amazon Sellers Need to Know

Once more, the United States finds itself at the heart of a worldwide economic shift. On April 2, 2025, President Donald Trump declared significant tariff hikes. His goal was to alter trade agreements and penalize nations he deemed “unfair” in their dealings with the U.S.

This occurrence, dubbed “Liberation Day,” signifies an escalation in the trade conflict. It represents a direct and intense disruption to global supply chains, especially those serving e-commerce giants like Amazon. The repercussions for Amazon sellers are immediate and complex.

Summary of Latest Tariff Developments

Here is a summary of the three main phases of the April 2025 Trump tariffs. These tariffs changed global trade policy. Each phase has direct effects on Amazon sellers and their supply chain choices.

April 2, 2025 – “Liberation Day” Announcement

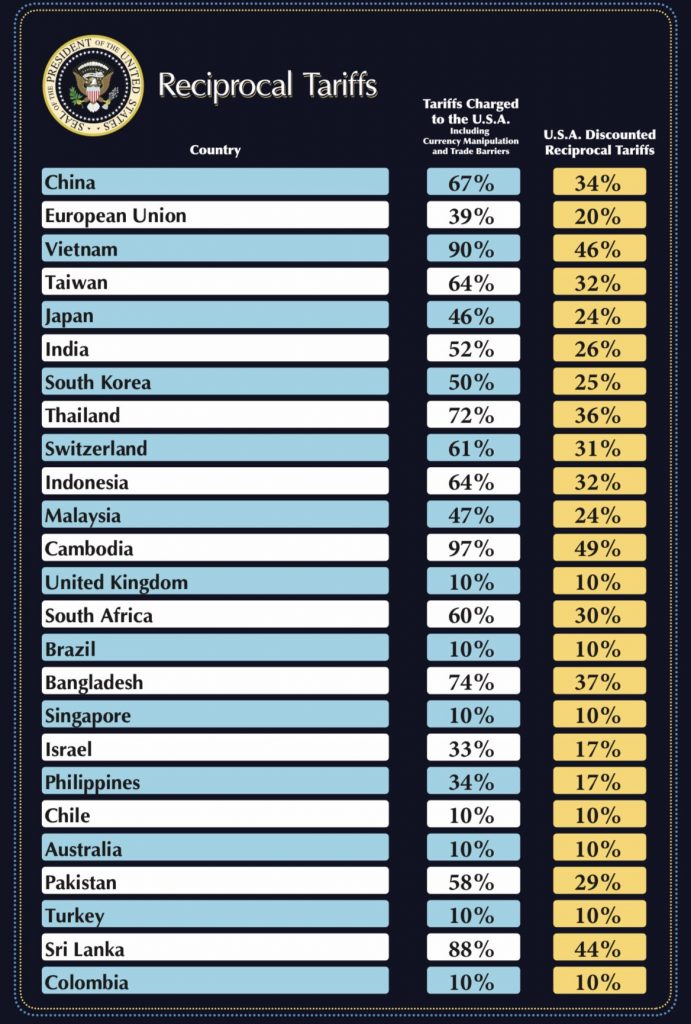

On April 2, President Donald Trump started a big trade plan called “Liberation Day.” He announced tariffs on over 90 countries. Tariff rates ranged from 10% to 50%, with China facing 34%, the EU 20%, and broad measures applied across Southeast Asia. The move was framed as a correction to what Trump described as decades of unfair trade practices.

Trump’s tariff announcement

(Source: Truth Social)

April 9, 2025 – Strategic Pause

Just one week later, under mounting market pressure, including sharp declines in the Dow and S&P 500, Trump partially reversed course. Tariffs on about 75 countries were reduced to a flat 10%. This change is for a 90-day grace period, starting from April 5.

However, China remained excluded from this relief. Instead, its tariffs were raised dramatically to 145%, combining a base of 125% with an additional 20% linked to fentanyl-related penalties.

April 11, 2025 – China Retaliates

In response to Trump’s China tariffs, China increased its tariffs on U.S. imports from 84% to 125%. Chinese officials criticized the U.S. policy as unserious but indicated no further retaliation unless provoked. The financial markets reacted immediately, with the Dow dropping 200 points at the opening bell and the S&P 500 declining by 0.4%, reflecting growing investor unease.

Supply Chain Chaos: How Trump Tariffs Disrupt Amazon Sellers

The U.S.-China trade conflict has always been risky for Amazon sellers. However, the current situation is especially unstable. Here’s how:

Exploding Costs

The tariff spike to 145% on Chinese imports drastically shifts the unit economics for Amazon sellers who depend on Chinese manufacturing. For instance, a private-label seller sourcing a $5 product now faces nearly $7.25 in tariffs—before shipping and FBA fees. This erodes profit margins, sometimes turning previously viable products into financial sinkholes.

Operational Delays

Lead times increase as Chinese manufacturers re-evaluate market strategies or re-route orders through third countries. This latency disrupts replenishment schedules, particularly for high-volume sellers with just-in-time inventory strategies.

Buy Box Risk and Price Compression

Raising prices to offset tariffs threatens the Buy Box, Amazon’s conversion powerhouse, as the algorithm prioritizes competitive pricing. No seller is fully “unaffected,” but those sourcing from countries with lower tariffs, like India (26%) or Taiwan (32%), may gain a slight edge over China-dependent sellers. However, they still face the baseline 10% tariff. For instance, a U.S. seller hiking prices on a $20 item to cover a $7 tariff could lose sales to competitors with pre-tariff inventory or cheaper sourcing.

Buy box risk and price compression

Inventory and Cash Flow Strain

Higher tariffs mean sellers need more capital to maintain stock levels. Small businesses, already stretched by Amazon’s fees, face tighter cash flow, delaying reorders or new product launches. Stockpiling pre-tariff inventory is a temporary fix, but restocks will hit the full tariff rate, squeezing margins further.

Consumer Pushback

Passing tariff costs to customers risks lower demand, especially for non-essential goods like apparel or gadgets. As prices rise (for example, a $40 toaster might go up to $48), conversion rates may fall. This could make sellers rely more on PPC ads to stay visible, which can reduce profits even more.

How Amazon Sellers Can Get Ready for the Changes

Trump’s tariffs, with 145% rates on Chinese imports and a 10% baseline across all trade partners, are shaking up the Amazon FBA landscape. To thrive amid rising costs, delays, and competitive pressures, sellers need to act strategically. Here’s a detailed roadmap to adapt and protect your business:

Recalculate Costs with Precision

Tariffs directly inflate landed costs, so sellers must recalibrate pricing to stay profitable without alienating customers. Use Amazon’s FBA Revenue Calculator to input new tariff rates. E.g, a $10 product from China now carries a $14.50 tariff (145%), pushing the total cost to around $24.50 with shipping and fees.

Analyze each SKU to decide whether to absorb some costs, raise prices modestly, or discontinue low-margin items. For example, a 10% price hike on a $30 product adds $3, which may be sustainable if paired with strong branding. Regularly revisit calculations as tariffs or freight rates shift and monitor PPC budgets, as higher prices may require increased ad spending to maintain visibility.

Re-route Sourcing to Minimize Tariff Impact

Dependence on Chinese suppliers is riskier than ever with 145% tariffs. Diversifying sourcing is critical to cutting costs and maintaining competitive pricing:

- Explore Lower-Tariff Countries: Use sourcing platforms like Alibaba or Jungle Scout’s Supplier Database to find manufacturers in countries like India (26% tariff), Taiwan (32%), or Thailand (baseline 10%). These regions offer cost savings over China, though production may cost 15-25% more than pre-tariff Chinese rates. For instance, a $5 gadget from India might cost $6 but avoid $7.25 in Chinese tariffs.

- Consider U.S. Manufacturers: Domestic sourcing eliminates import tariffs and appeals to “Made in USA” shoppers, boosting brand value. However, expect 30-50% higher production costs—e.g., a $5 Chinese product might cost $7.50 stateside. Platforms like ThomasNet can connect you with U.S. factories for private-label goods.

- Nearshore for Speed: Suppliers in Mexico or Canada face 25% tariffs, but proximity cuts shipping times from 6-8 weeks (Asia) to 1-2 weeks. This reduces inventory holding costs and mitigates delays. For example, a Mexican supplier might charge $6 for a product versus $5 from China, but you save on freight and gain flexibility.

Vet new suppliers carefully—request samples, check references, and negotiate terms to offset setup costs. Transition gradually to avoid disrupting top SKUs.

Re-route sourcing to minimize tariff impact

Stock Strategically to Buffer Price Hikes

Tariffs hit restocks hardest, so build inventory now to delay cost increases. Prioritize your top 20% of SKUs (per Pareto’s principle), which likely drive 80% of revenue. For example, if a $15 product sells 1,000 units monthly, stock 3,000 units (3 months) before tariffs fully apply, locking in pre-tariff pricing. Use Amazon’s Inventory Performance Index to optimize stock levels and avoid long-term storage fees ($0.87-$2.40 per cubic foot monthly).

Coordinate with suppliers for bulk orders to secure discounts, but balance against cash flow, as overstocking ties up capital. If delays arise (e.g., 2-4 weeks from Chinese factories), this buffer prevents stockouts during peak seasons like Q4.

Strengthen Branding to Justify Price Adjustments

Small price hikes are inevitable, but strong branding can maintain customer loyalty and Buy Box competitiveness. Invest in:

- Enhanced Listings: Use A+ Content, high-quality images, and keyword-optimized titles to differentiate your products. For instance, a $25 kitchen gadget with a unique design or eco-friendly claim can justify a $2-3 price bump over generic rivals.

- Customer Engagement: Build loyalty with follow-up emails offering discounts or guides (via Amazon’s Request a Review tool). Loyal buyers are less price-sensitive, reducing churn from tariff-driven increases.

- Bundle Offers: Combine products to make them seem more valuable. For example, sell a $20 item with a $5 accessory for $24. This hides a price increase while raising the average order value.

Tools like Helium 10’s Listing Builder can improve listings. This helps them rank higher naturally. It can also reduce ad costs if prices go up. A strong brand lets you hold the Buy Box even at a slight premium.

Negotiate with Suppliers to Share the Burden

Don’t assume suppliers will pass on 100% of tariff costs. Leverage long-term relationships to negotiate better terms:

- Split Costs: Propose a 50/50 tariff split—e.g., for a $5 product with a $7.25 tariff, you pay $3.63, keeping costs manageable.

- Bulk Discounts: Commit to larger orders for 10-20% off unit prices, offsetting tariff hits. For example, a $6 item might drop to $5 with a 5,000-unit order.

- Payment Terms: Request 30-60 days of payment extensions to ease cash flow while restocking. Platforms like Sourcify can mediate these talks with vetted factories. Start negotiations early, as suppliers face their own pressures and may prioritize flexible partners.

Diversify Revenue Streams to Reduce Risk

Tariffs expose overreliance on single products or markets. Spread risk by:

- Adding Low-Tariff SKUs: Launch items from countries with lower tariffs, like India at 26%. A $10 t-shirt from India might cost $12.60 with tariffs versus $17.25 from China. You can also include categories that are not affected, such as digital products like print-on-demand.

- Expanding Sales Channels: Sell on Walmart, eBay, or Shopify to reduce Amazon dependency. These platforms have lower fees (e.g., Walmart’s 8-15% vs. Amazon’s 15-20%), giving wiggle room for tariff costs.

- Testing New Markets: If U.S. demand softens due to price hikes, target Canada or Europe via Amazon’s global selling program, where tariffs may differ. Tools like Jungle Scout’s Opportunity Finder can identify high-demand, low-competition niches to pivot into quickly.

Conclusion

The April 2025 tariff upheaval demands swift, strategic action from Amazon sellers. Adapting your sourcing, pricing, and inventory plans is crucial to stay competitive. If you’re still struggling to secure cost-effective, tariff-smart suppliers, don’t go at it alone. Sign up for a free consultation with Zonpal’s Product Sourcing service and get expert help tailored to your Amazon business needs.